Special Types of Financing

1- Lease Financing

What is leasing? Lease financing is one of the popular and common methods of assets based finance, which is the alternative to the loan finance. Lease is a contract. A contract under which one party, the leaser (owner) of an asset agrees to grant the use of that asset to another leaser, in exchange for periodic rental payments. Lease is contractual agreement between the owner of the assets and user of the assets for a specific period by a periodical rent.

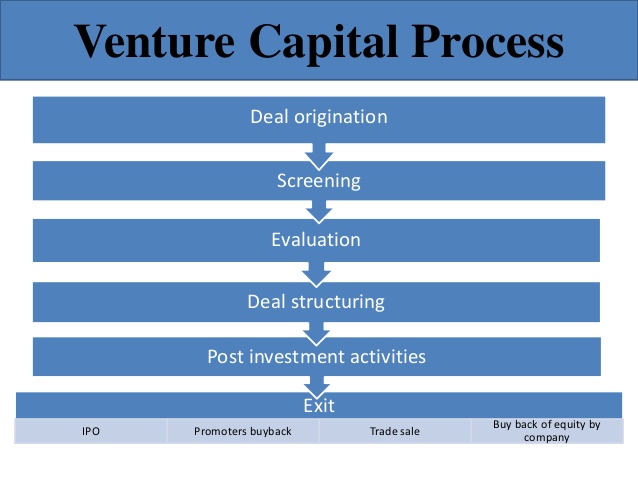

2- Venture Capital

What is venture capital? Venture capital is defined as providing seed, start up and first stage financing and also funding expansion of companies that have already demonstrated their business potential but do not yet have access to the public securities market or to credit oriented institutional funding sources. Venture Capital also provides management in leveraged buyout financing.

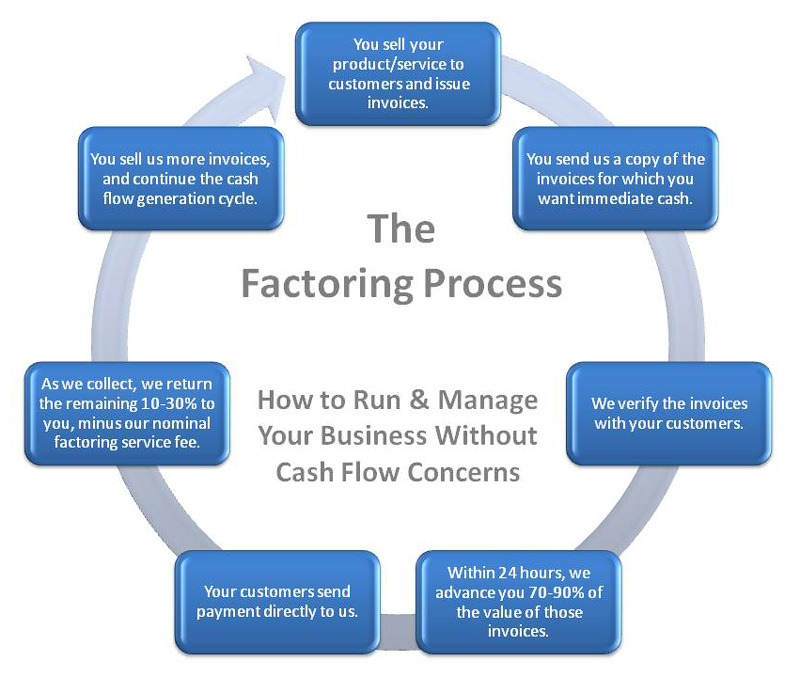

3- Factoring

What is Factoring? Factoring is a service of financial nature involving the conversion of credit bills into cash. Accounts receivables, bills recoverable and other credit dues resulting from credit sales appear, in the books of accounts as book credits. Here the risk of credit, risk of credit worthiness of the debtor and as number of incidental and consequential risks are involved. These risks are taken by the factor which purchase these credit receivables without recourse and collects them when due. These balance-sheet items are replaced by cash received from the factoring agent.

4- Foreign Direct Investment

What is FDI? FDI is the category of international investment that reflects the objective of a resident entity in one economy (direct investor or parent enterprise) by obtaining a ‘lasting interest’ and control in an enterprise resident in another economy (direct investment enterprise). The IMF definition of FDI includes as many as twelve different elements, namely: equity capital, reinvested earnings of foreign companies, inter-company debt transactions including short-term and long-term loans, overseas commercial borrowings (financial leasing, trade credits, grants, bonds), non-cash acquisition of equity, investment made by foreign vantage capital investors, earning data of indirectly held FDI enterprises, control premium, non-competition fee and so on.

5- Merchant Banking

What is merchant banking? Merchant banking is one of the fee based financial services which includes underwriting, consultancy and other allied services to the business concern. A merchant banking is one who underwrites corporate securities and advises clients on issue like corporate mergers. Merchant banking is basically service banking which provides non-financial services such as issue management, portfolio management, asset management, underwriting of new issues, to act as registrar, share transfer agents, trustees, provide leasing, project consultation, foreign credits, etc.

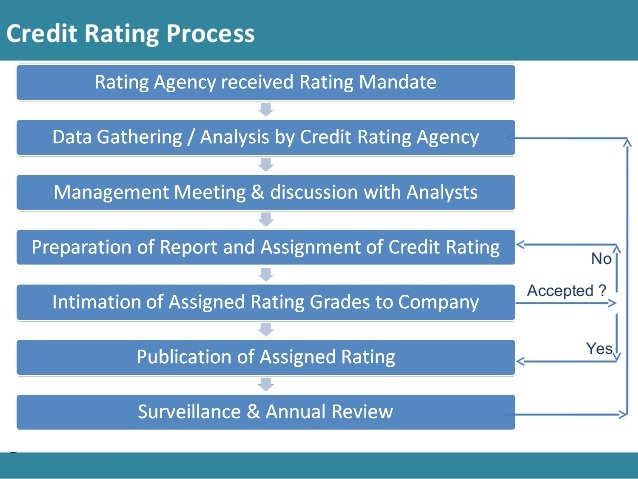

6- Credit Rating

What is credit rating? It is a mechanism by which the reliability and viability of a credit instrument is brought out. It is usually the effort of investors in financial instrument to minimize or eliminate default risk. Credit rating service is useful to the investors.

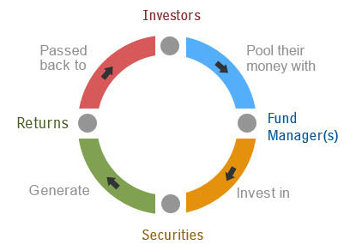

7- Mutual Funds

What is a mutual fund? Mutual fund is one of the funds based financial services which provides the stock market benefits to small investors. It is a concept, leading to attract the small investors to invest their pooling of savings in a trusted as well as profitable manner. Mutual funds act as a link between the investor and the stock market.